Lululemon Athletica (NASDAQ: LULU) — Undervalued Champion Poised to Outperform

Author’s Note: We are long Lululemon stock and stand to benefit if its share price increases. All information presented here is derived from public records and sources, which are cited. We invite readers to review these sources and form their own conclusions.

Executive Summary

Lululemon Athletica is a severely undervalued growth champion in athletic apparel, trading at beaten-down valuations despite industry-leading fundamentals. Prevailing market skepticism – over slowing U.S. trends, one past misstep (the Mirror acquisition), and competition – has created a mispriced opportunity for investors. In reality, LULU’s global growth engine (especially in China), expanding product lines (menswear, footwear), and fanatically loyal customer base underpin a trajectory that Wall Street fails to fully appreciate. With operating margins back near record highs and returns on capital above 25%, LULU generates robust cash flows enabling aggressive buybacks and strategic investments. We believe the stock’s ~60% drop from its peak is unwarranted, and that Lululemon’s Board and Executives should recognize the disconnect and act to unlock value. In this bullish activist report, we detail how misperceptions have pummeled LULU’s share price, why those bears are wrong, and how Lululemon’s underappreciated strengths position the company to prove skeptics wrong. We conclude with pointed questions for management to drive accountability and close the gap between LULU’s operational performance and its lagging stock price.

1. Market Misperceptions vs. Reality

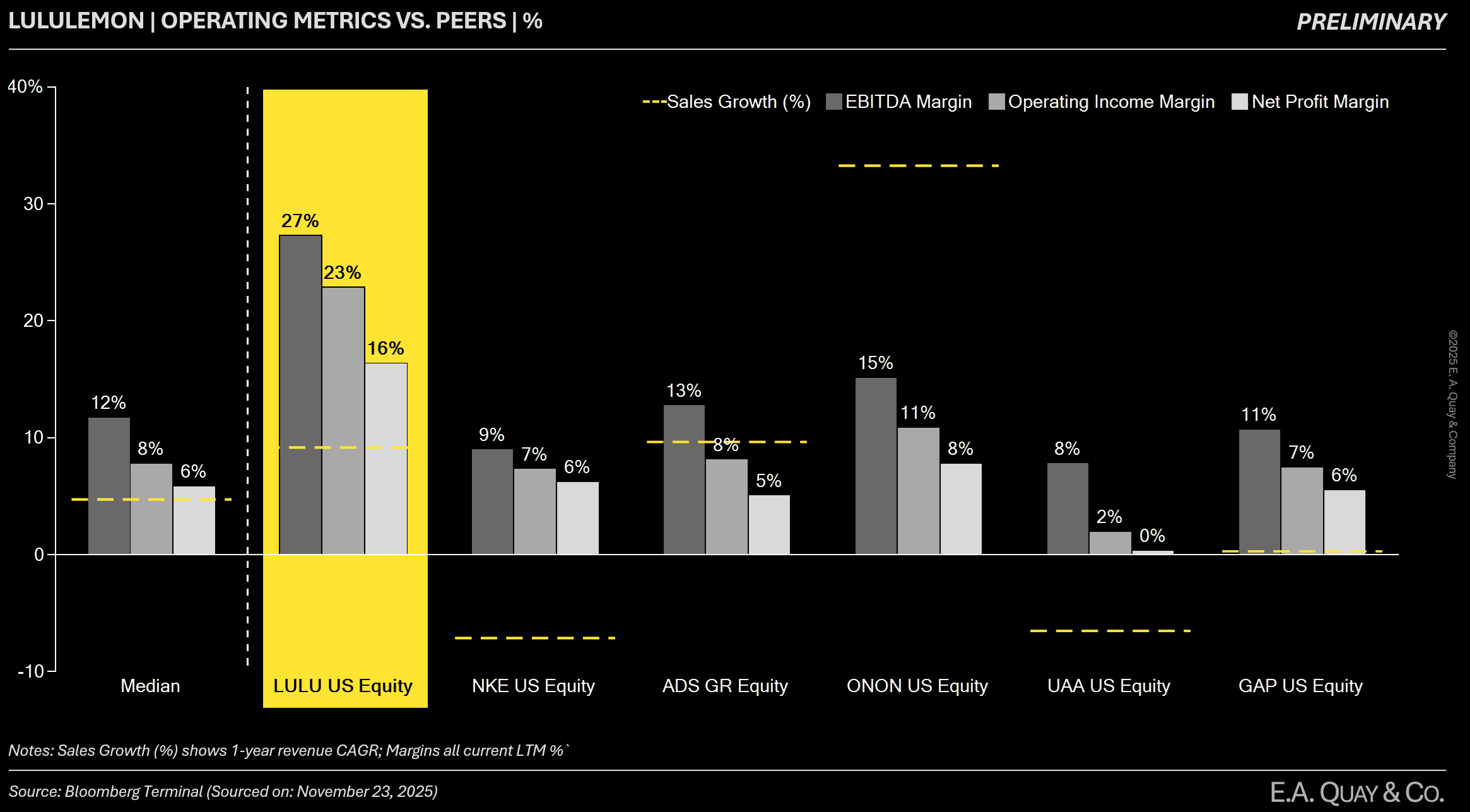

The bear case is built on outdated narratives and shortsighted fears. Skeptics point to slowing North America growth, rising competition, and the ghost of Lululemon’s Mirror flop as signs the company’s best days are over. In reality, these concerns are either temporary or overblown, and the company’s recent results obliterate many of the doomsday prophecies. Misperception: “Lululemon’s growth is stalling, especially in a saturated U.S. athleisure market.” Reality: LULU grew revenues 18% in 2023 and 10% in 2024 (despite macro headwinds), outpacing virtually all peers. International sales are booming (+34% last year) even as U.S. comps pause. Misperception: “Margin pressures (high inventory, discounts) will erode profitability.” Reality: LULU’s gross margin expanded to 59% – far above Nike’s mid-40s gross margins – and operating margin increased to 23.7% in 2024. Inventories have and LULU has largely avoided heavy discounting thanks to its pricing power. Misperception: “Competition from giants (Nike, Adidas, Under Armour) and niche brands (Athleta, Vuori, Beyond Yoga, Alo) will steal share.” Reality: LULU continues to take market share in the athletic apparel space through its focused brand identity and community connection. As Nike struggled with declining profits and Adidas dealt with its own crises, Lululemon’s revenue grew much faster (20%+ CAGR over a decade vs. Nike’s ~6%). No competitor replicates LULU’s yoga/community-centric moat. Misperception: “The Mirror fiasco shows management’s poor judgment and threatens LULU’s tech ambitions.” Reality: Yes, the 2020 Mirror acquisition was a rare mistake – but management has swiftly course-corrected (as we detail later), minimizing further losses and refocusing on core strengths. In short, the market’s worries are either transient issues that LULU is overcoming or misinterpretations of LULU’s prudent investments for the future. We find the negative narratives deeply disconnected from the company’s actual performance.

In the same vein, sentiment around LULU has been negatively skewed by cautious analysts and high-profile skeptics. When Q4 2024 guidance came in conservative, the stock fell ~10% amid hyperbolic commentary that Lululemon’s era of growth was ending. This knee-jerk pessimism ignored that LULU was prudently guiding in a soft economy – a far cry from a broken growth story. We believe these short-term sentiment swings have obscured the long-term picture: Lululemon is continuing to execute exceptionally well. For instance, while some fretted that U.S. comps went flat in late 2024, they overlooked that LULU deliberately pulled back on excessive inventory and discounting, protecting margins and brand integrity. International comps still rose a dazzling 22%, proving that demand remains robust where LULU is expanding. The fears of “brand fatigue” in North America also ignore the reality that LULU still posted positive 8% revenue growth in the Americas last year despite lapping explosive pandemic-fueled gains – hardly a collapse, and likely a baseline for reacceleration as the macro environment improves.

Bottom line: The market has been fighting the last war, focusing on past challenges (Mirror, supply chain hiccups, etc.) and missing the current reality of LULU’s accelerating global business and strategic agility. This misalignment between perception and reality sets the stage for significant upside, as we expect the narrative to catch up to the facts in coming quarters. Our report next quantifies just how stark Lululemon’s undervaluation has become in light of these misperceptions.

2. Valuation Disconnect: LULU vs. Peers and History

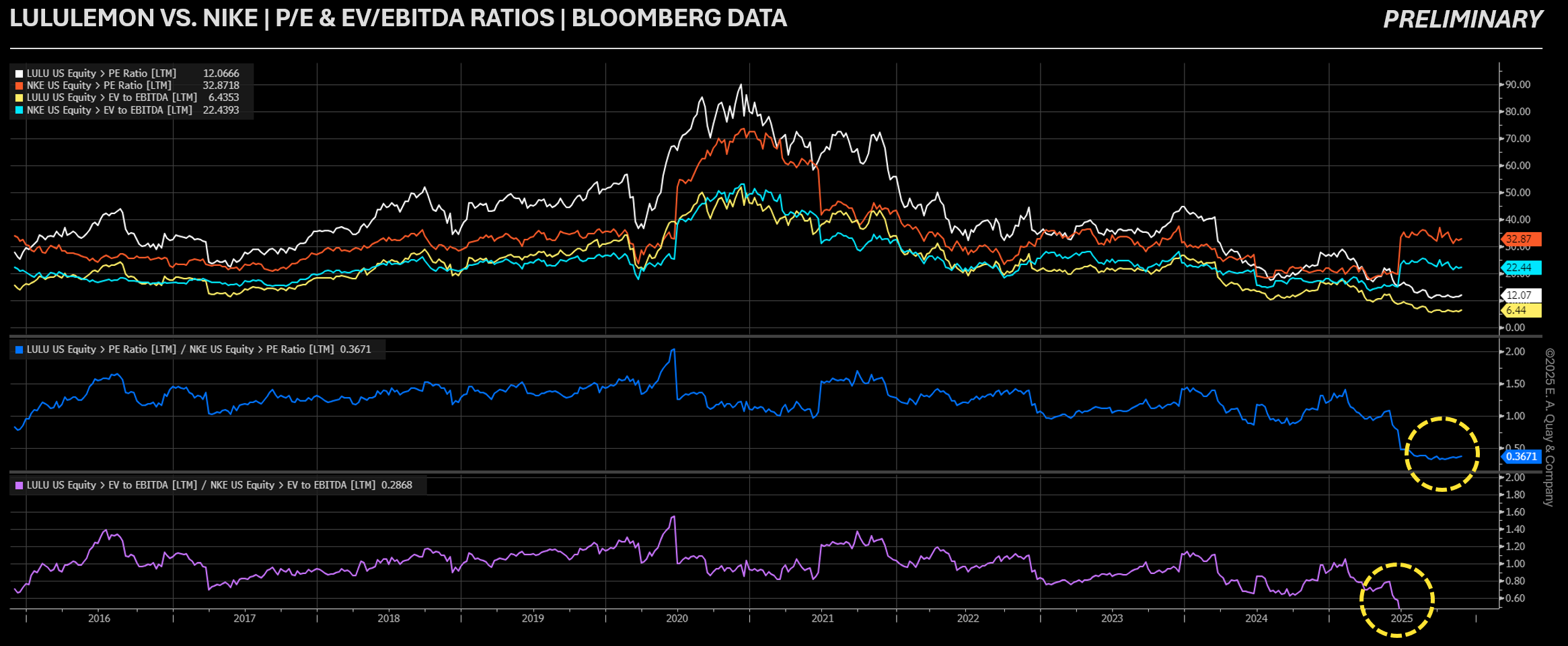

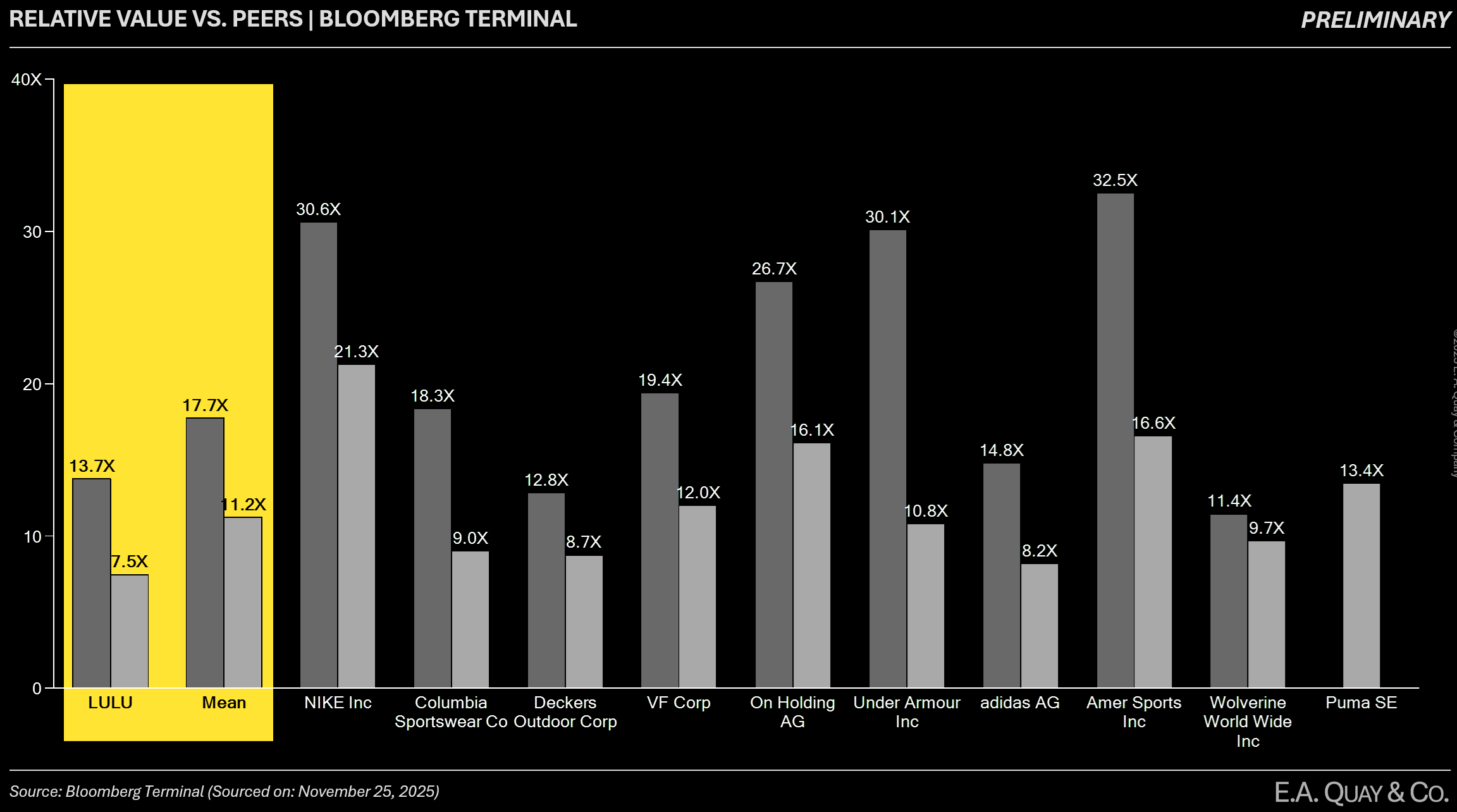

Lululemon’s stock is priced for failure, but the company is delivering success. The valuation metrics tell a shocking story: LULU now trades near multi-year lows on earnings and cash flow multiples, despite growing faster and earning higher margins than almost any competitor. This disconnect is an open invitation for savvy investors. At around $168 per share (mid-November 2025), LULU’s market cap is only ~$20 billion – a fraction of Nike’s ~$100+ billion – even though LULU’s revenue (~$10.6B) is over one-fourth of Nike’s and rising much faster. LULU’s forward P/E is ~13×, a steep discount to the apparel industry average of ~16× and far below LULU’s historical average of ~31×. In fact, one analysis noted Lululemon is trading at just one-third of its 5-year average EV/EBITDA multiple – a deep value multiple for what remains a growth company. LULU’s enterprise value is roughly 6.8× its TTM EBITDA, according to Bloomberg, whereas Nike changes hands at ~14× and the broader sector ~10×. This is a dramatic re-rating: LULU’s EV/EBITDA was routinely 20–30× during its high-growth phase, and even with more moderate growth now, an 6.8× multiple appears irrationally low for a premium brand with expanding international momentum.

Critically, Lululemon’s depressed valuation stands in contrast to many peers and “hot” athletic names. For example, upstart On Holding (ONON) trades at nearly 3× LULU’s forward earnings thanks to market hype around its running shoes – yet Lululemon, with far larger profits and proven brand equity, trades at a fraction. Even Nike, after its stock decline, still commands a forward P/E of ~30× and forward EV/EBITDA of ~21×, both more than double LULU’s level. The market seems to be treating LULU as if it were an ex-growth or structurally impaired retailer – which could not be further from the truth. We note that LULU’s 5-year revenue CAGR (2018–2023) was ~21%, while Nike’s sales are effectively flat. LULU also has best-in-class margins. Yet today investors can buy LULU at roughly half of Nike’s valuation metrics. The divergence is striking.

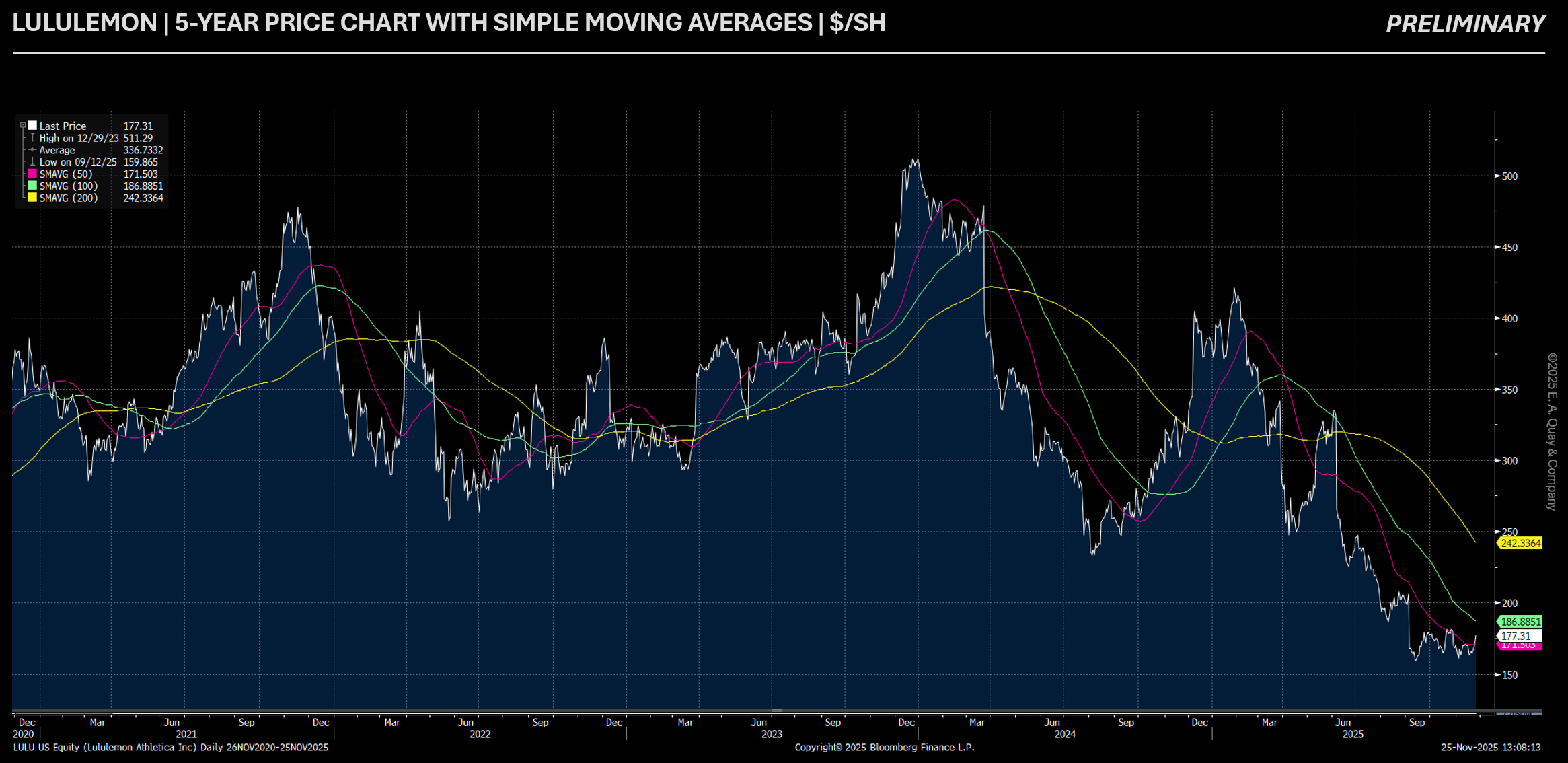

So what’s driving this disconnect? In our view, a combination of herd psychology and short-term noise. LULU’s share price hit an all-time high of around $470 in late 2023, then tumbled ~60% to ~$168 as of mid-November 2025 as growth cooled from torrid pandemic levels and the Mirror overhang spooked some investors. Once the stock had that downward momentum, negative narratives fed on themselves, and LULU became a “show-me story” again. But the underlying business never fell apart – it kept compounding sales and earnings, making today’s bargain valuation possible. Simply put, Lululemon’s earnings have grown into the stock (and then some). The result: LULU now sports trailing and forward P/E ratios in the low teens, which is an all-time low.

To illustrate the upside potential, consider a simple scenario. If LULU can earn around $14–15 EPS in FY2025 (slightly above current consensus) given ongoing growth. Applying even a modest 20× P/E (still below LULU’s historical average and under Nike’s current multiple), we’d get a stock price of $280–300, roughly 70–80% above the recent ~$168. If LULU were to be valued at parity with the broader apparel industry on EV/EBITDA (say ~10×), it would imply a share price around $230 – again significantly above current. And those scenarios assume no re-acceleration in growth; any positive surprise (e.g. a few quarters of reaccelerating comps or better margins) could justify a premium multiple and push the stock even higher.

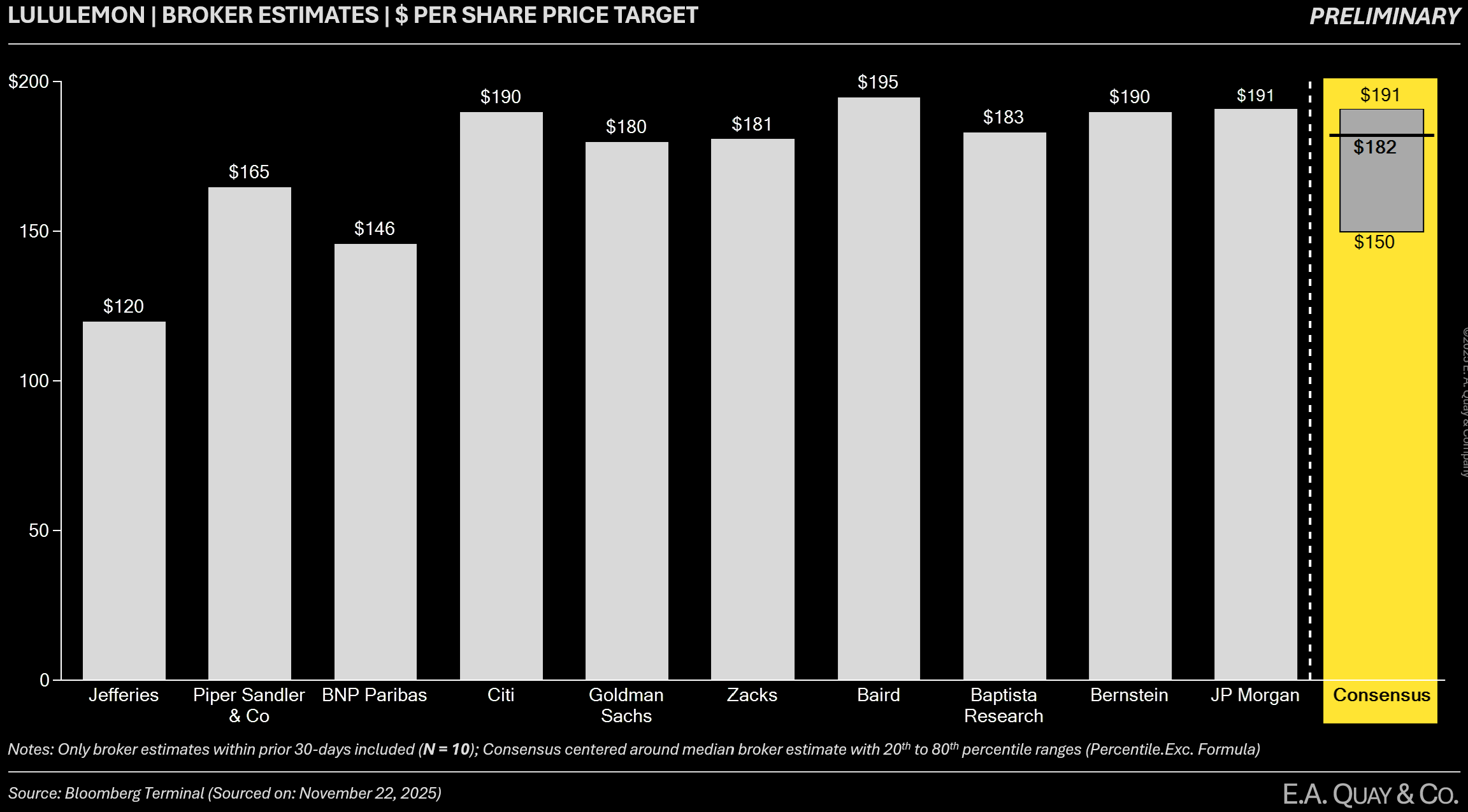

This valuation disconnect has not gone unnoticed by all. Some independent analyses (e.g. SimplyWallSt and others) calculate LULU is 30–40% undervalued based on intrinsic value models. Yet, curiously, Wall Street’s consensus price targets remain muted (consensus price target is currently $190/sh), suggesting analysts are hesitant to buck the negative narrative. This sets up a classic contrarian opportunity. We believe that as LULU continues to post solid results – and especially if any one of its growth initiatives exceeds the tepid expectations – the market will be forced to rerate the stock upward. In essence, LULU offers growth stock upside at value stock pricing, an extremely attractive combination.

In summary, the numbers don’t lie: LULU’s stock is priced for calamity while the business is performing admirably. The recent share price slump appears to have been an emotional overshoot. With the valuation groundwork laid, we now turn to the core strengths of Lululemon that underpin our bullish view – starting with its unique brand power and cult-like customer loyalty that competitors can only envy.

3. Brand Strength, Community, and Customer Loyalty – LULU’s Intangible Moat

Lululemon isn’t just selling yoga pants; it’s selling a lifestyle and community. The company has meticulously built an aspirational brand with fiercely loyal customers, which translates into pricing power, repeat business, and low markdown reliance. Key indicators – from net promoter scores to sales per square foot – confirm that LULU’s brand equity is second to none in retail. This “cult brand” status forms an economic moat that competitors struggle to match, and it’s a major reason why we believe LULU can sustain premium growth and margins.

LULU’s App-Only Black Friday Presale:

LULU’s app #5 in Apple App Store

Consider Lululemon’s customer loyalty metrics. In independent surveys, LULU scores an extremely high Net Promoter Score (NPS) – one report put it at 83, which is world-class by any standard. (For context, an NPS above 50 is considered excellent.) This means Lululemon’s customers enthusiastically recommend the brand to others, reflecting deep satisfaction and loyalty. Similarly, Lululemon’s membership program has exploded in size: the free “Essential” membership program now counts 28 million members, up 65% year-over-year. These are astonishing figures – 28 million people (nearly the population of Texas) have signed up to be in LULU’s ecosystem, gaining access to early product drops, community events, and more. The company smartly expanded this program after initially piloting a paid loyalty membership; the result is a massive database of engaged fans that LULU can draw on for repeat sales and product feedback. In the first five months after relaunching membership, LULU gained 9 million new sign-ups (with over 30% utilizing benefits), showing how eager customers are to deepen their relationship with the brand. LULU’s recent 2025 early Black Friday sale was exclusively available to member’s in its Android and IOS app. After launching the presale, LULU’s IOS app surged into the top 10 iPhone App Store apps – with the likes of ChatGPT, Google, etc.

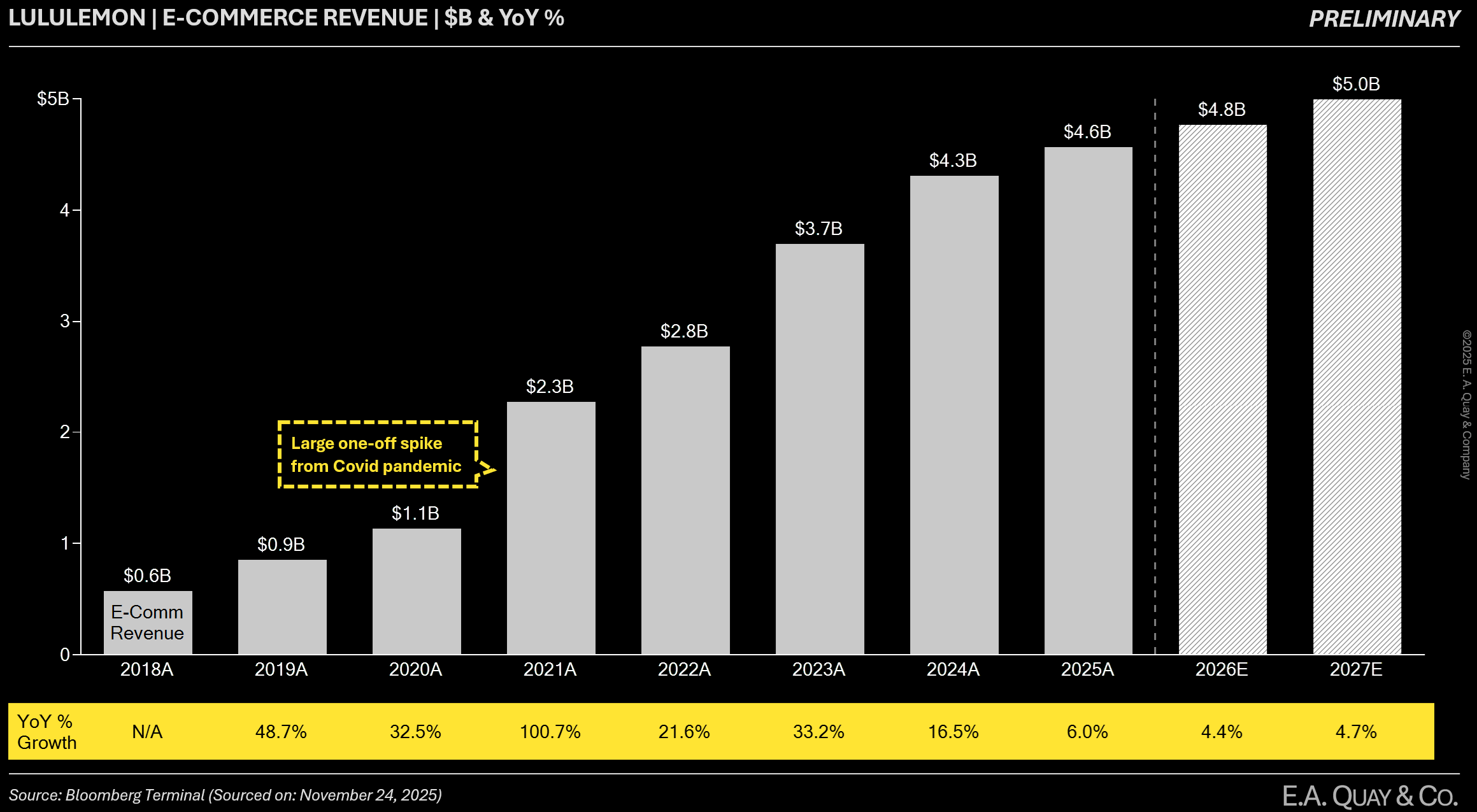

Perhaps the most telling statistic of brand strength is sales productivity. Lululemon’s stores are money-printing machines in terms of revenue per square foot. In fiscal 2023, LULU hit $1,609 sales per sq. ft., up from $1,580 in 2022. This is an elite figure in retail – by comparison, Apple’s famously high-traffic stores do about $5,000 per sq.ft., but among apparel retailers LULU is near the top. It far outpaces mall staples or competitors; for instance, LULU’s $1,600+ is several times Athleta’s (Gap Inc doesn’t break it out, but Gap’s overall is around ~$400) and comfortably above Nike’s own direct retail stores. Such productivity signifies that each Lululemon store is a destination with steady foot traffic and full-price sell-through, driven by product desirability and community engagement. Moreover, LULU’s e-commerce (~40% of revenue) adds another powerful channel – one that grew 300% since the Pandemic – showing that the brand resonates both in-store and online.

Lululemon’s marketing strategy has always been atypical – and effective. Instead of splashy ads, it invests in community-building and word-of-mouth. The company hosts free yoga classes and run clubs at stores, nurtures a network of over 1,700 local ambassadors (trainers, athletes, even mindfulness coaches), and sponsors events like the Lululemon SeaWheeze half marathon. This grassroots approach yields authentic connections. We see it in China, for example, where LULU organized “Sweatlife” festivals and the Summer Sweat Games drawing 10,000+ participants across 40 cities – embedding the brand in the local fitness culture. These efforts translate to a tribe-like customer base that is far less price-sensitive. During 2022’s inflation surge, many apparel retailers resorted to heavy discounting; Lululemon largely held the line, and customers kept buying, a testament to perceived value. As the NFL’s Chief Revenue Officer observed in partnering with LULU, the brand has “a loyal fan base built on culture and meaningful connections” – an asset that thoroughly impressed even a major sports league.

Another advantage of LULU’s brand: multi-generational and multi-gender appeal. Historically known for women’s yoga wear, Lululemon today is embraced by men, women, teens, and even professional athletes. It’s not uncommon to see an entire family sporting the logo. The product quality and feel create evangelists – customers who start with one pair of Align tights or ABC pants and before long have a closetful of LULU gear. Notably, Lululemon ranks #1 in brand loyalty for women’s athletic apparel in multiple surveys, and it’s quickly climbing the ranks for men as well. CEO Calvin McDonald has highlighted that new customers typically ramp up spend significantly in their second and third years, showing strong retention. And founder Chip Wilson, always has emphasized that cultivating a certain aspirational ethos (centered on wellness, mindfulness, “sweat life”) would give LULU a unique cachet. That vision clearly endures, as Lululemon remains synonymous with quality and self-improvement in the minds of consumers.

In summary, Lululemon’s brand strength is an economic moat protecting it from competition and downturns. It enables premium pricing (full-price sell-through is high), mitigates advertising spend (the community spreads the word organically), and supports expansion into new categories (loyal customers try new LULU offerings eagerly). When we see 21% of customers labeled “detractors” in one generic NPS source, we take it with a grain of salt – more robust indicators like the 83 NPS and the growth of membership tell the true story of a beloved brand. Any analysis that doubts LULU’s brand power – as some bears do – is simply not paying attention to the real-world evidence of loyalty. This durable brand equity underpins the company’s financial success, which we explore next in terms of margins and cash flow.

4. Margin Recapture and Robust Cash Flows (Mirror Is in the Rearview)

Lululemon’s profitability is back on the upswing, as one-off drags fade and the core business flexes its leverage. After the costly Mirror experiment knocked margins down in 2022, LULU has swiftly recaptured lost margin and is now running at near-record profitability. Gross margins have rebounded to nearly 60%, and operating margin hit 23.7% in FY2024 – up from 2023 and ahead of pre-Mirror levels. This margin resilience is critical: it shows that LULU’s growth isn’t coming at the expense of profitability. On the contrary, Lululemon’s business model (direct-to-consumer, premium pricing, controlled distribution) yields a highly profitable enterprise with abundant cash generation. In turn, these cash flows are being used to reward shareholders via aggressive buybacks and to reinvest in growth avenues – a virtuous cycle.

First, let’s address Mirror, the connected-fitness device Lululemon acquired in 2020. By 2022, it was clear the purchase was ill-timed (at the pandemic’s peak) and that Mirror’s hardware sales were disappointing. The financial impact was significant: LULU took a $443 million impairment charge related to Mirror in Q4 2022, which dragged that year’s GAAP operating margin down to just 16.4%. It was one of the few blemishes on LULU’s track record. However, management did not allow this to become a chronic drain. In 2023, Lululemon pivoted – deciding to discontinue selling the Mirror hardware by end of 2023 and cease in-house content production. They struck a smart partnership with Peloton (more on that later) to provide content to existing Mirror users, effectively cutting off the bleeding. By excluding Mirror-related charges, we see LULU’s true earnings power: adjusted EPS in 2023 was $12.77, nearly double the $6.68 GAAP EPS of 2022 which had Mirror write-downs. In other words, once the Mirror mistakes are stripped out, LULU’s earnings growth trajectory remains intact. The company’s adjusted operating margin bounced back to 22.1% in 2022 and 23.2% in 2023 (versus ~16% GAAP in 2022), underscoring that Mirror was an aberration. Now with Mirror fully wound down (the last inventory charges were taken in 2023), Lululemon’s reported margins are normalizing upward – GAAP op margin was 23.7% in 2024, and a hefty 28.9% in the seasonally strong Q4. The “margin recapture” is essentially complete, and going forward LULU can focus on incremental improvements rather than digging out of a hole.

Crucially, Lululemon’s profitability quality is very high. Gross margin expanded 90 bps to 59.2% in 2024, approaching its all-time highs. This reflects easing supply chain costs (lower air freight and markdowns in 2023 vs 2022) and the inherent advantage of LULU’s vertical model. Whereas many apparel companies suffer margin dilution from wholesale distribution, Lululemon sells predominantly through its own stores and website (with DTC making up 42% of sales). It captures the full retail markup. Additionally, LULU’s product mix skews to higher-margin apparel and accessories, and its brand strength allows minimal discounting. The result: LULU’s gross margin is ~14 points higher than Nike’s (which was ~45% last year), and higher even than luxury names like Gucci parent Kering (~55%). Very few apparel companies hit 60% gross margin; LULU is in that elite club. This gives plenty of cushion to invest in SG&A for growth initiatives while still delivering strong operating profits. On the cost side, Lululemon has shown discipline. Despite opening 50+ stores annually and expanding digital capabilities, it leverages scale in corporate overhead. In 2024, operating expenses grew slower than sales, yielding that op margin uptick. Store productivity gains (sales per sq.ft. rising) mean fixed costs (rent, store labor) are spread over more revenue.

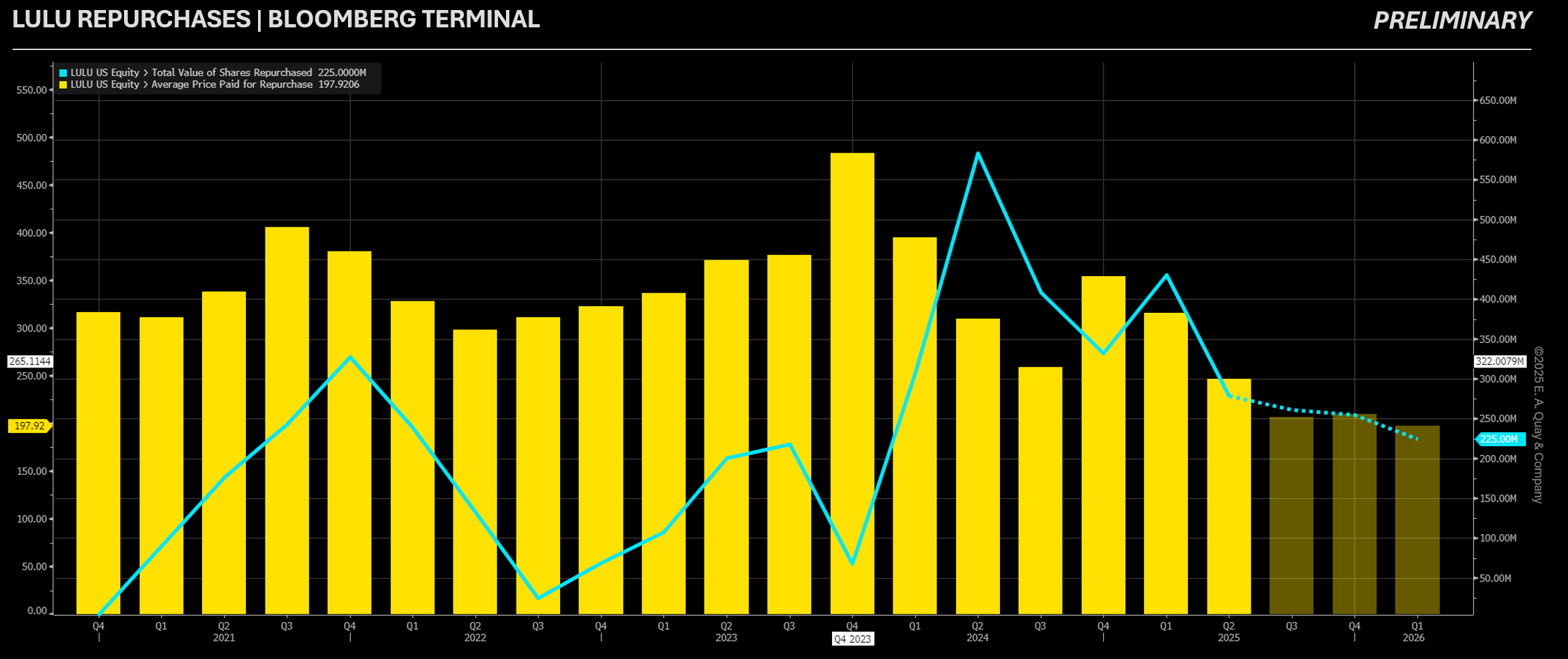

The upshot of robust margins is powerful cash flow. Lululemon generated over $2+ billion in operating cash flow in the last twelve months, funding growth and returning cash to shareholders. Even after pandemic disruptions and the Mirror saga, LULU’s balance sheet is pristine – a far cry from many retailers that carry heavy debt. This gives LULU strategic flexibility and resilience. Importantly, management is not letting that cash sit idle: they are buying back stock at these depressed prices. In 2024 (FY ending Jan 2025), LULU repurchased 5.1 million shares for $1.6 billion – that’s roughly 4% of shares outstanding retired in one year. And they’re not done. The Board has further authorization to continue an aggressive buyback program, signaling confidence in the company’s future. In Q3 2023 alone, LULU bought ~0.6M shares at an average $380/share (ironically much higher than today’s price), and in Q4 2024 they bought another 0.9M at ~$369. Now, with the stock down to ~$168/share, ongoing buybacks stand to be even more accretive. We applaud this capital allocation: management is effectively saying they believe the stock is a bargain – a view we heartily share.

Put simply, Lululemon’s financial engine is humming. It boasts higher margins and returns on capital than almost any specialty retailer. LULU converts a big chunk of earnings to free cash flow, and it’s using that to both reinvest (new stores in growth markets, innovation in product) and repurchase shares aggressively. The Mirror detour is firmly in the rearview mirror – and ironically, having learned from that, management seems even more focused on core execution and shareholder returns. We would not be surprised if LULU initiates a dividend in coming years, given cash generation, but for now buybacks make the most sense at this valuation.

To conclude this section: Lululemon has proven its ability to adjust and maintain elite profitability. The narrative of “margin pressure” is outdated – margins are rising, not falling. The company’s cost structure and pricing power provide a buffer in any downturn, and its cash war chest provides optionality (whether to invest or return capital). This is not a fad or low-quality growth story; this is a highly profitable growth story. Next, we dive into one of the biggest growth drivers that the market underestimates: Lululemon’s international expansion, especially the rocket-ship trajectory in China.

5. International Expansion: The Underappreciated Growth Engine (China in Focus)

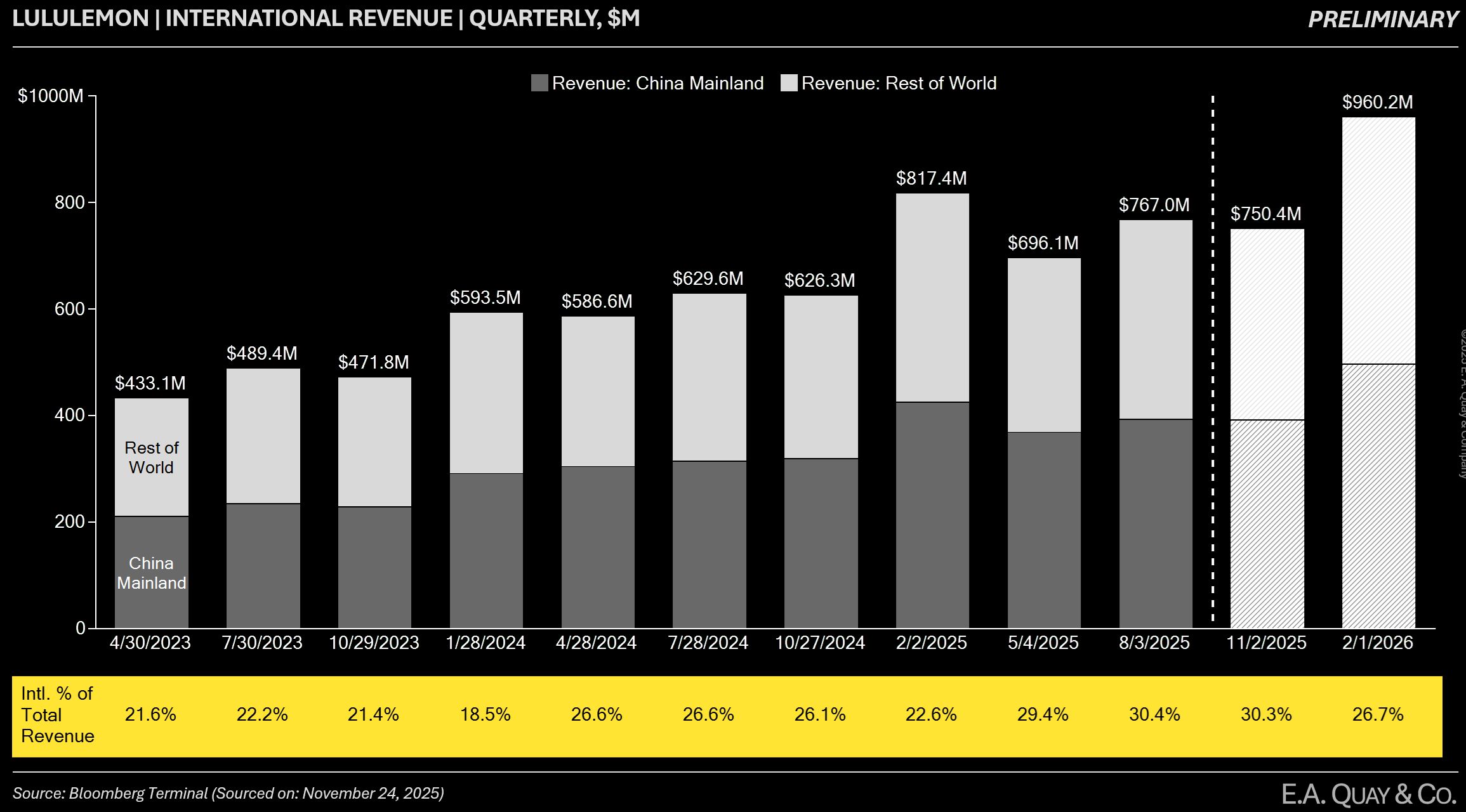

Lululemon’s international business is on fire – and it’s just getting started. While skeptics fixate on a maturing U.S. market, LULU’s overseas segment (from Asia to Europe) is scaling at extraordinary rates, dramatically shifting the company’s mix. In the most recent quarter, international sales jumped +49% year-on-year, and for full-year 2024 they surged 34% (36% in constant currency) – vastly outpacing the 4% growth in North America. International now represents roughly 26% of LULU’s revenue (FY2024), up from just ~15% in 2021. Management’s Power of Three ×2 plan explicitly targets a quadrupling of international revenue from 2021 to 2026, and current trends show LULU is well on track, if not ahead, of that ambitious goal. The market, in our view, does not fully appreciate how powerful this international momentum is – especially in China, where Lululemon is emerging as a status symbol and athletic staple for affluent consumers.

Breakdown by region underscores the seismic shift underway. In 2021, the Americas (mostly U.S. and Canada) provided 85% of sales while Mainland China was only ~7%. Fast forward to 2023: Americas share dropped to 79%, Mainland China doubled to 10%, and other international markets (Europe, APAC ex-China) made up 11%. That means over 21% of revenue came from outside North America by 2023 – a remarkably fast change. The trend continued in 2024: LULU disclosed that revenue rose 41% in China Mainland and 27% in Rest of World during the year, vs just +4% in Americas. Indeed, in Q4 2024, international comps were +20% while Americas comps were flat. Lululemon has hit critical mass in some key global markets, and is leveraging brand heat that in many cases exceeds what the company saw in its early U.S. days. For example, in China, Lululemon surpassed $1 billion in annual net revenue by 2024 – an impressive milestone achieved barely a decade since entering the country. And there’s so much runway ahead: Nike does over $8B in Greater China, showing the TAM for athletic apparel there. LULU capturing just a fraction of that indicates multi-billion dollar potential in China alone.

What’s driving this international success? Several factors:

- Brand resonance globally: The themes Lululemon stands for – health, mindfulness, premium quality – have universal appeal. The brand has smartly localized its approach (e.g. using Chinese ambassadors, celebrating local festivals) while maintaining its global cachet. Chinese consumers have embraced LULU as a aspirational Western brand, akin to how they took to Apple or Starbucks in earlier waves. In Europe, LULU is still relatively nascent but is seen as a high-end technical label, often with little direct competition in the yoga segment. Importantly, no entrenched local competitor dominates the “athleisure” niche abroad like LULU does. This white space allows LULU to expand rapidly where it plants the flag.

- Aggressive store expansion and omni presence: Lululemon is opening stores at a rapid clip internationally, particularly in Asia. In 2023 alone, they opened 28 net new stores in Mainland China (rising from 99 to 127 stores). Total APAC stores (excluding China) also grew from 91 to 98, and EMEA stores from 46 to 48 (plus many new franchise locations in the Middle East). Each new store not only adds sales, but acts as brand advertising and a community hub in markets where awareness is still building. Additionally, LULU’s digital capabilities mean that even in countries with few stores, customers can buy online. The company noted it launched local e-commerce sites and partnerships (like on Tmall in China, Zalando in Europe) to reach beyond physical footprint. This omni-channel approach accelerates international penetration.

- Localization and cultural adaptation: Unlike some American brands that failed abroad by assuming a “one-size-fits-all” approach, Lululemon has been thoughtful. Example: in Asia, it offers more modest styles and bright colorways for local tastes, and sizes that accommodate different body types. They also integrate community events that resonate locally – e.g., in Seoul they partner with K-pop fitness influencers, in London they sponsor yoga classes in parks. This drives word-of-mouth in each region.

The numbers speak volumes. For full-year 2024, international (which includes Asia-Pacific and EMEA) reached about $2.8 billion in sales, more than double what it was just two years prior. Mainland China alone was over $800M and is on pace for $1B+. Critically, these markets are far from saturated. LULU’s brand awareness in China and Europe is growing but still has headroom. For perspective, LULU has ~150 stores in China (including Hong Kong/Taiwan) for a population of 1.4 billion, versus ~440 stores in the U.S./Canada for ~360 million people. The runway to expand in tier-2 Chinese cities, as well as across Europe (only 48 stores in EMEA presently, with huge untapped markets like France at just 6 stores) is enormous. Management knows this: in 2024 they opened 56 net new stores globally (14 of which were converting Mexico franchise stores) and plan 40–45 more in 2025, with roughly two-thirds of new openings slated outside North America. They even announced entry into new countries like Spain, Italy (ahead of the 2026 Olympics), and upcoming expansions in untapped markets—including the launch of franchise stores in India. This is growth that can sustain high-teens international CAGR for years.

Another tailwind: the athleisure trend is global and still in early innings abroad. In many international markets, the idea of wearing yoga pants or joggers as everyday attire became mainstream later than in North America. So LULU benefits from a secular trend of more people adopting health & wellness lifestyles and casualization of fashion. Analysts project the sportswear market globally to grow ~3-4% annually, but LULU is clearly outpacing that by multiples in its focus regions. For example, Europe’s athletic apparel per capita spend trails the U.S., implying catch-up potential. LULU doesn’t need unrealistic market share to thrive – it just needs to continue executing and leveraging its brand appeal to capture a fraction of the large markets in front of it. We believe the international segment could feasibly reach ~30%+ of total revenue by 2026 (on a much larger total base), given the current trajectory. That mix shift is important because international growth not only adds revenue, but also improves diversification and reduces over-reliance on the U.S. economy.

Despite these facts, many U.S. investors and analysts give international growth a cursory nod at best. It’s often mentioned as an aside (“LULU is expanding globally”) but not truly modeled for its profound impact. We think this is a major oversight. International momentum is a key to LULU’s next leg of growth and a big part of why we’re bullish. As a thought experiment, if LULU were a China-focused story (like some high-flying consumer brands that IPO in the U.S.), its 40% growth in China would be a headline driver. But because LULU is still thought of as a North American retailer, the market hasn’t fully re-rated it for the global angle. That’s an opportunity. Every quarter that LULU posts ~30–40% international increases (and the company has done so consistently), confidence in the growth plan should increase – eventually demanding a higher multiple for the stock.

In conclusion, global market expansion is transforming Lululemon. China is emerging as a second pillar nearly as important as the U.S., and Europe/Rest-of-world is adding meaningful incremental growth. By 2026, LULU’s goal of doubling overall revenue to $12.5B looks achievable largely because of international gains (as well as men’s business growth, our next topic). The undervaluation of LULU today fails to account for this rich vein of international growth that’s being tapped. Investors who recognize the international story are effectively getting a high-growth global retail business for free at the current valuation.

6. Menswear and New Categories (Footwear): Growth Levers Hiding in Plain Sight

Executive Summary: Lululemon is no longer just “yoga pants for women.” The company’s strategic expansion into menswear and other product categories (like footwear) is yielding impressive results, adding new layers of growth that many skeptics underrate. Men’s apparel at Lululemon has been growing faster than women’s, on track to eventually rival the size of the women’s business. In 2024, men’s revenue jumped +14% (versus +9% in women’s), continuing years of double-digit menswear growth. Men’s now accounts for ~24% of LULU’s revenue, up from ~20% a few years ago, and the mix is rising toward management’s goal of parity with women’s long-term. Meanwhile, Lululemon’s foray into footwear – a natural adjacency in the athletic space – has been well-received, with the company launching its first women’s running shoe in 2022 and its first-ever men’s footwear line in 2024. These initiatives expand LULU’s addressable market (TAM) by billions of dollars and deepen customer engagement (a loyal LULU apparel customer is likely to try LULU shoes, for example). The upside from fully scaling these new categories is substantial and not yet reflected in the company’s overall valuation, in our view.

Men’s Business: From Niche to Mainstream. It’s worth recalling that Lululemon started as a women-focused yoga brand. The fact that nearly a quarter of sales are now menswear is a testament to the brand’s successful crossover. Products like the ABC pants (LULU’s famous “anti-ball crushing” chino-like pants for men) and the Metal Vent training tops have become staples in many men’s wardrobes – prized for comfort and versatility. LULU’s men’s segment has grown at roughly a 20%+ CAGR over the last five years (management even doubled its men’s revenue from 2018 to 2022, hitting an initial goal early). Now under the Power of Three ×2 plan, they aim to double men’s again from 2021 to 2026. The trajectory is strong: for instance, in Q2 2023, men’s business grew in the mid-20s percent, significantly outpacing women’s, as noted on earnings calls. By the end of 2024, we estimate men’s annual revenue was in the ~$2.5 billion range (roughly 24% of $10.6B total). Importantly, the men’s customer profile expands LULU’s reach. More than half of men shopping at Lululemon are new to the brand (didn’t previously buy women’s products for a partner, etc.), so this isn’t just upselling existing female customers – it’s capturing a new demographic.

The runway in men’s is huge: Nike and Adidas each do tens of billions in men’s sales. LULU’s product development for men is hitting its stride, with expansions into golf polos, outerwear, swim, and casual streetwear (the “License to Train” line, etc.). LULU is also leveraging partnerships to boost men’s awareness – note that they signed top golfer Max Homa and rising tennis star Frances Tiafoe as ambassadors in 2024, putting the brand in front of a predominantly male sports audience. The collaboration with the NFL and NHL (discussed later) is also explicitly aimed at courting male sports fans with team-branded Lululemon gear – including athlete ambassadors such as D.K. Metcalf. These moves address a historical gap: brand awareness among men lagged women. Now that’s changing – ask a random college-aged male about Lululemon and chances are he’ll mention the super-comfortable ABC pants or shorts that “everyone is wearing at the gym.” In a telling anecdote, Lululemon’s line for men’s boxer briefs (introduced quietly) became a top seller, illustrating how once men discover LULU quality, they want it in all categories. We foresee men’s share of LULU’s revenue climbing to 30%+ in the next few years, which effectively means hundreds of millions in incremental revenue on top of women’s growth. This is an internal growth vector that many don’t fully credit – but it is analogous to when Nike successfully pushed into women’s apparel two decades ago, creating a new multi-billion line of business.

Footwear: Stepping into a New $300+ Billion Market. Lululemon’s move into footwear is a logical extension: its customers trust the brand for apparel, so why not shoes? Still, the company approached it methodically. Rather than rushing to market, LULU spent years on R&D to create differentiated products. In March 2022, they debuted the “Blissfeel” – a running shoe specifically engineered for women’s feet (a shot across the bow of traditional shoemakers who historically designed for men first). The Blissfeel launch was a success – often selling out in popular sizes, and praised for its comfort. Building on that, LULU rolled out additional styles: Chargefeel (cross-training shoe) and Strongfeel (for gym/strength). Having proven demand and gathered feedback from women, Lululemon took the major step in 2024: launching its first men’s shoes. The “Chargefeel 3” and “Restore” were among early men’s training shoes, and notably the “Beyondfeel” running shoe for men launched in March 2024 alongside a unisex sneaker called “Cityverse” in February 2024. The Beyondfeel is LULU’s first men-specific running shoe, and early reviews cited by GQ and others noted its quality and style for everyday runs. Essentially, LULU is following a playbook: start in women’s footwear (underserved by performance brands), learn and refine, then tackle men’s (a larger market). Footwear is a tough category – dominated by Nike, Adidas, and specialized players – but LULU doesn’t need huge market share to move the needle. Even a low-single-digit share of the athletic footwear space would equate to several billion dollars in sales. For context, On Holding (maker of On Running shoes) is expected to hit ~$2.8B revenue this year and trades at a rich valuation, largely on optimism for its shoe growth. If LULU’s footwear initiative can capture the devotion of just its existing loyal apparel base, it could build a ~$500M+ footwear business in a few years. This is essentially upside optionality that current valuations do not bake in.

Management is optimistic but prudent on footwear. They have said the footwear rollout is a long-term project – they aim to “create an iconic footwear business”, not chase short-term volume at the expense of brand (so they aren’t flooding the market or doing heavy discounts). Already, footwear has contributed to attracting new customers, especially men, into Lululemon stores (“come for the shoes, stay for the ABC pants”). It also increases share of wallet for existing customers. One can imagine LULU in a few years selling head-to-toe solutions: top, bottom, underwear, socks, and shoes – all with the Lululemon logo. Each additional category makes the brand stickier.

Outside of men’s and shoes, LULU has a few other nascent categories worth mentioning: personal care products (like deodorants, dry shampoo), which are very small but speak to lifestyle brand extension; and a recently teased foray into pickleball equipment (they partnered with a pickleball paddle maker for a co-branded product in 2023). These are not likely to move the financial needle near-term, but they indicate LULU’s willingness to carefully experiment at the edges of its brand permission.

To sum up, Lululemon’s growth is not confined to expanding geographically – it’s also expanding horizontally into new product areas. The men’s business is flowering, addressing a market easily as large as LULU’s historical women’s niche. The footwear push, while still small, holds significant promise and can leverage the brand’s textile and design expertise (for example, LULU’s Slide sandals quickly became popular, suggesting the brand can credibly play in casual footwear). Importantly, these efforts are still gaining momentum. We believe the market doesn’t fully appreciate how much growth is embedded here: many analysts model men’s and footwear conservatively, perhaps due to cautious management commentary, but if men’s keeps outpacing and any footwear style becomes a hit, top-line estimates could prove too low.

Lululemon’s ability to broaden its portfolio without diluting brand equity is a bullish signal about management’s execution. Few companies successfully cross the gender divide or break into shoes (recall Under Armour’s struggles in women’s, or others failing in footwear), but LULU is doing it methodically. This multi-pronged growth – women’s, men’s, international, shoes – gives LULU multiple shots on goal. Even if one area softens temporarily, others can pick up slack. It’s a hallmark of a well-rounded growth story, not a one-trick pony. Next, we discuss how LULU’s recent strategic pivots and partnerships (including with former competitor Peloton, and major sports leagues) further set the stage for long-term success.

7. Strategic Pivots and Partnerships: Turning Past Blemishes into Future Opportunities

Lululemon’s management has demonstrated agility by pivoting away from missteps and forging strategic partnerships to expand the brand’s reach. Three major recent moves stand out: (1) the decision to exit the hardware side of Mirror and partner with Peloton for fitness content, (2) new partnerships with the NFL and NHL (via Fanatics) to produce co-branded fan apparel, and (3) new $300/year credit partnership with Amex Platinum cardholders. These actions highlight a company that is learning from mistakes and creatively leveraging its strengths. Exiting Mirror’s hardware business cuts losses and frees LULU to focus on what it does best (apparel/community), while teaming with Peloton turns a former rival into an ally and opens a new channel for LULU apparel. Likewise, collaborating with sports leagues taps into massive fan bases and invites a new demographic to experience Lululemon, all with minimal inventory risk (thanks to Fanatics’ distribution). We view these strategic pivots as savvy and underappreciated catalysts for LULU’s brand and financial performance.

LULU’S $500M Mirror Mistake:

Lululemon’s “Mirror” interactive fitness device (now discontinued) being used for at-home strength training. LULU took swift action to pivot away from hardware and focus on core apparel and community offerings.

Let’s start with the Mirror saga and Peloton partnership. After spending $500M to acquire Mirror in 2020, Lululemon found itself in the crowded at-home fitness market just as gyms were reopening. By 2022, Mirror sales lagged and LULU wisely acknowledged the sunk cost. Rather than stubbornly doubling down, management made the tough but correct call to cut bait. In September 2023, LULU announced it would discontinue Mirror device sales by year-end 2023 and shut its digital-only content tier. Simultaneously, Lululemon struck a five-year global partnership with Peloton – a move that seemed to surprise the market (Peloton’s stock popped on the news). Under this deal, Peloton becomes LULU’s exclusive digital fitness content provider, and LULU in turn becomes Peloton’s primary athletic apparel partner. This is elegantly symbiotic. For LULU: it instantly solves the content problem – instead of pouring money into creating workouts for Mirror, LULU can now offer its Lululemon Studio members access to Peloton’s vast library of classes (cycling, yoga, strength, etc.). In fact, from Nov 1, 2023, Mirror (Studio) subscribers automatically got Peloton content as part of their membership, ensuring a smooth transition with no service loss. LULU also avoided stranding existing Mirror customers – it’s continuing to support the devices and honor subscriptions, but without the heavy ongoing cost of content creation. For Peloton: they cease their own apparel attempts and instead partner with the most coveted brand in yoga/athleisure, Lululemon, selling co-branded LULU × Peloton workout gear in Peloton’s channels. Peloton instructors also become LULU ambassadors, linking the communities. This effectively ends the earlier feud (Peloton had even been sued by LULU for copying designs in 2021]) and turns a potential competitor into a collaborator.

Why is this Peloton deal bullish for LULU? Two reasons: cost savings and new revenue. On cost, LULU immediately halts the bleeding from Mirror. They laid off 120 employees in the Mirror division in mid-2023, and by Q3 2023 took a one-time inventory write-down of ~$24M and a post-tax $72M impairment to clear it off. Going forward, no more production costs, no more content spend for digital fitness – Peloton handles that. Wedbush’s retail analyst applauded this, saying “it ends the saga of one of LULU’s few strategic missteps… $500M acquisition of Mirror… [and] there’s an opportunity to generate incremental revenue from being Peloton’s apparel partner”. That incremental revenue is key: Peloton has ~7 million members, many of whom are hardcore fitness enthusiasts squarely in LULU’s target market. Now Lululemon is Peloton’s exclusive apparel partner, meaning when those members want branded workout clothes, they’re directed to LULU’s product (with Peloton logo alongside). Starting October 2023, LULU x Peloton co-branded apparel is sold in Peloton stores and on Peloton’s website across the U.S., UK, and Canada. This opens a fresh distribution channel for LULU product without needing new LULU stores. It also introduces LULU to Peloton’s loyal user community in a positive light, potentially winning new customers. While financial details weren’t disclosed, we suspect LULU likely gets a wholesale-like arrangement for supplying these co-branded goods (Fanatics is handling distribution for the league deals, but Peloton deal seems direct). Even if modest, it’s a nice tailwind – essentially found money – atop eliminating the Mirror drag. Furthermore, aligning with Peloton bolsters LULU’s credibility in digital fitness without needing to build it all in-house. Peloton’s content is top-tier; LULU can still offer a “Studio” membership experience (with Peloton’s classes) and use it to engage its 28M members by cross-promoting apparel and events. It’s turning a negative (Mirror) into a neutral or even slight positive, which is exactly what good management does.

Now on to the NFL and NHL licensed apparel partnerships, which represent an ingenious way for LULU to court new customers (especially men) and drive additional sales with minimal capital outlay. In October 2024, Lululemon announced a deal with Fanatics and the NHL to create a line of premium fan apparel for 11 NHL teams initially, expanding to all 32 teams by the 2025-26 season. This was followed in October 2025 by the announcement of a similar partnership with the NFL for all 32 football teams. These collections feature popular Lululemon styles (like the Define jacket, Scuba hoodie, Align leggings for women; and the Steady State joggers, Metal Vent tech shirts for men) emblazoned with team logos and colors. Essentially, LULU is bringing its quality and aesthetic to fan gear – a segment historically dominated by less fashionable merch. The products are sold on NFLShop.com, team stores, Fanatics’ sites and Lids stores, leveraging Fanatics’ massive sports retail network. Fanatics, a powerhouse in sports licensing, handles a lot of the heavy lifting (distribution, likely inventory management to some degree). This is crucial: LULU gets the upside of selling into a passionate fan market without having to rely solely on Lululemon stores to move team-specific inventory (which could be risky if a certain team’s items don’t sell out). Fanatics being involved suggests LULU’s inventory risk is mitigated – possibly Fanatics places orders and handles unsold stock akin to a wholesale partner.

We view these league collaborations as a win-win. For LULU, it’s immediate legitimacy in the sports fan domain and access to a predominantly male audience that may not have considered Lululemon before. The NFL partnership news alone sent LULU shares up ~5% in one day (although they later retraced lower), indicating investors recognize the significance. The NFL is the most watched and monetized sport in North America, and LULU is now an officially licensed partner – notably the first time Lululemon has offered any team-licensed products. That’s a big deal: it means the leagues trust LULU’s brand enough to let it make fan apparel, and it means sports fans will now see the Lululemon name in contexts they never did (like NFL online shop). Imagine the gift-giving scenarios too – e.g., a man who is a huge Dallas Cowboys fan gets a Cowboys-branded Lululemon hoodie; he experiences LULU’s quality and may become a direct customer. Meanwhile, LULU loyalists who happen to be sports fans are thrilled they can rep their team without sacrificing style or comfort. We expect high demand particularly for teams in cities where LULU is popular. LULU’s President summed it up: “true NFL fans wear their pride...we looked to honor that devotion and are thrilled to be part of that ritual”. This emotional connection – linking LULU gear to team loyalty – could pay dividends in brand affinity.

Financially, even a modest penetration of the fan apparel market could add tens of millions in revenue. Fanatics sold $3+ billion of licensed sports merch in 2022; if LULU grabs a slice of premium sales for 32 NFL teams, it could be meaningful. But even more important is the strategic angle: it’s effectively low-cost customer acquisition. LULU doesn’t need to open new stores or big marketing campaigns to reach these folks; the NFL/NHL logos draw them in. It’s savvy marketing disguised as product expansion.

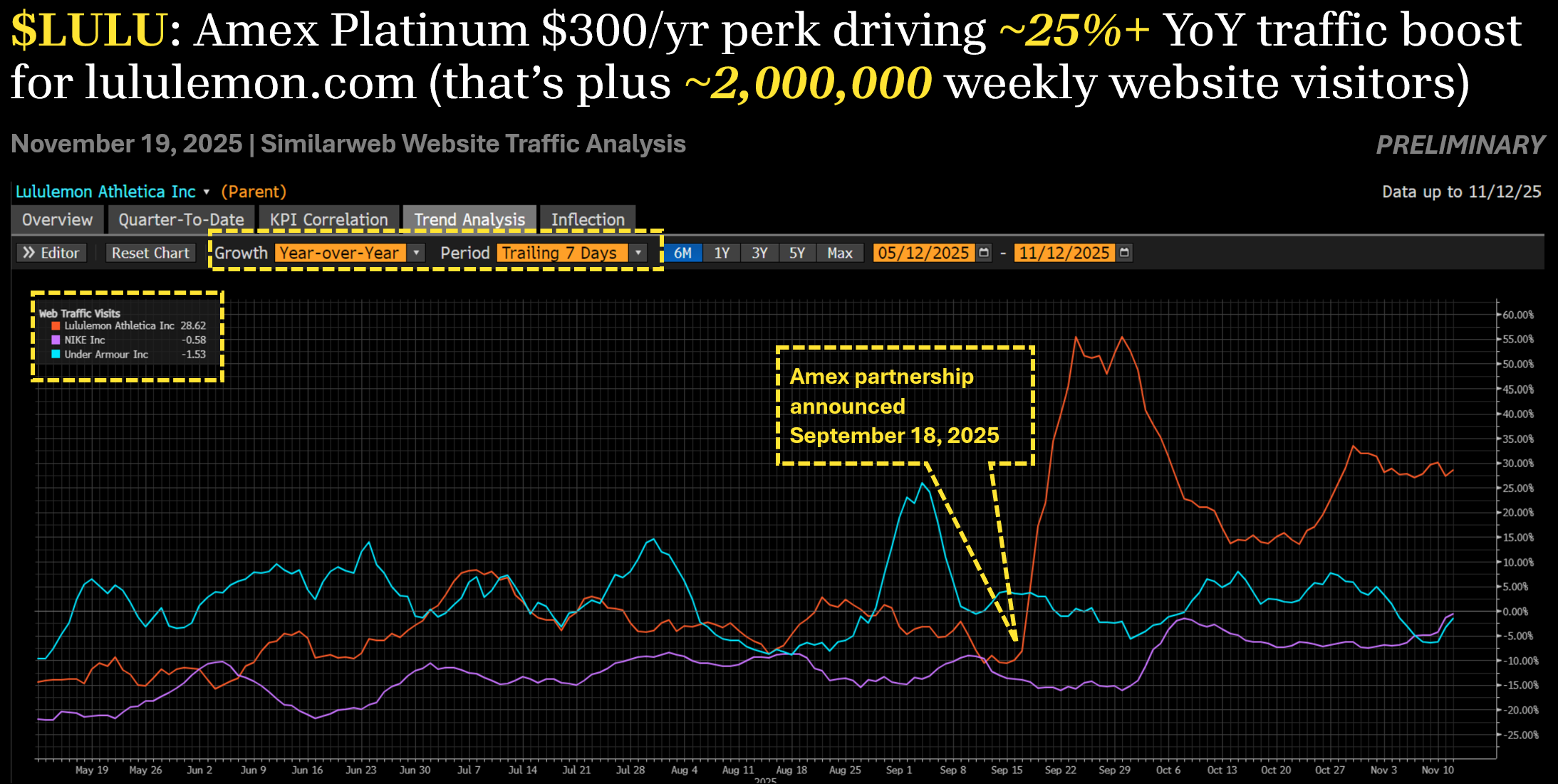

Another underappreciated strategic win is Lululemon’s September 18, 2025 partnership with American Express Platinum, which effectively turns Amex into a recurring, third party demand engine for LULU. As part of the Platinum “refresh,” Amex raised the annual fee from $695 to $895 but added over $3,500 of annual value, including a $300 Lululemon credit – delivered as up to $75 in statement credits per quarter for eligible purchases at U.S. Lululemon stores (excluding outlets) and on lululemon.com, with enrollment required. Lululemon and Amex both prominently market the partnership; LULU’s own site positions it as “Move into more with lululemon and the American Express Platinum Card,” underscoring that the brand has been chosen as the athletic wear partner in Amex’s revamped wellness centric benefits stack. Travel/points outlets immediately highlighted the Lululemon credit as one of the marquee new perks that helps offset the higher fee, and dedicated guides now coach Platinum holders on “best ways to spend” the $75 quarterly credit — effectively sending a steady stream of affluent, high intent shoppers directly into LULU’s ecosystem.

Crucially, the economics are attractive. The benefit is provided as a statement credit from Amex to the cardmember, so from Lululemon’s perspective these are standard full price transactions at full price channels. The quarterly cadence of the credit encourages habit — cardholders are nudged to visit lululemon.com or a store every three months or forfeit value — which shows up clearly in the data: Similarweb/Bloomberg traffic analysis indicates that following the launch, weekly visits to lululemon.com stepped up by roughly 25% year over year, or about +2 million incremental visitors per week, while Nike and Under Armour web traffic stayed flat to negative over the same window. In practical terms, Amex is now supporting a recurring influx of high income customers to LULU’s highest margin channels. Converting even a modest share of those Amex sourced customers into repeat customers should translate into meaningful incremental revenue over time — and further entrench Lululemon as the default premium athleisure brand for the very demographic that premium card issuers are fighting hardest to keep.

One more strategic note: LULU also quietly acquired its Mexico franchise operations in 2023, converting Mexico to a company-operated market. This shows willingness to take direct control when appropriate (in Mexico’s case, the market proved strong enough). They similarly might consider strategic acquisitions if any complementary brand made sense, but given Mirror’s lesson, they’ll be cautious. We doubt any large M&A is on the horizon – and none is needed – but small partnerships like the ones above can amplify growth.

In sum, Lululemon’s management deserves credit for confronting challenges head-on and turning them into opportunities. The Mirror fiasco could have cast a long shadow; instead, they decisively wrote it down and leveraged Peloton’s strength to fill the gap, simultaneously boosting apparel distribution. The venture into licensed sports gear could have been outside LULU’s comfort zone; instead, they partnered with an expert (Fanatics) and are meeting fans on their turf, literally. Similarly, with Amex Platinum, LULU has secured one more best-of-breed corporate partner. These moves demonstrate an adaptable, strategic mindset at the top – one that short-sellers often claim retailers lack. Far from being complacent, LULU is proactively finding new ways to grow and engage customers. This bodes well for long-term shareholder value, as it suggests a management team not content to rest on laurels, but also wise enough to partner where it benefits.

Next, we step back and look at LULU’s overall financial profile in context – comparing it to peers and highlighting the exceptional returns it generates – before wrapping up with our view on the stock’s upside and some pointed questions we think management should answer to further enhance shareholder confidence.

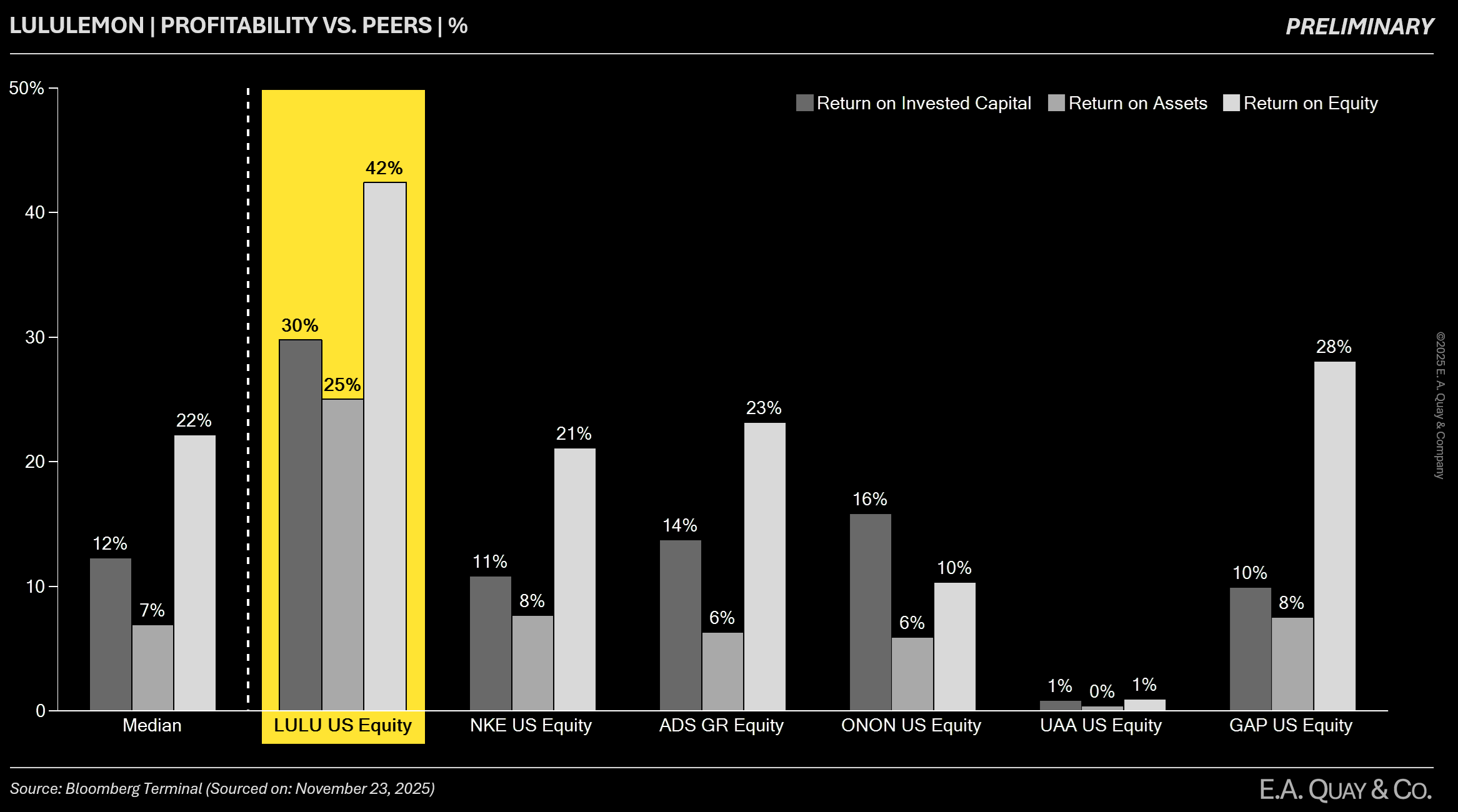

8. Financial Outperformance and Balance Sheet Strength: A Quality Compounder

By every key financial metric, Lululemon outshines its apparel peers. It boasts higher growth, fatter margins, and better returns on capital than competitors like Nike, Adidas, or Athleta (Gap). LULU’s balance sheet is debt-free and cash-rich, providing stability and optionality that many retail peers lack. The company’s disciplined stewardship of capital – investing for growth while returning excess cash via buybacks – aligns management’s interests with shareholders’. In this section, we underscore how Lululemon’s financial quality stands in stark contrast to its discounted valuation, making the long thesis even more compelling. LULU isn’t just another retailer; it’s a cash-generative, high-ROIC compounder with characteristics more akin to a tech platform than a mall store.

Let’s visualize the superiority:

These numbers illustrate a fundamental point: Lululemon’s business model is extraordinarily efficient and profitable. A dollar of revenue at LULU produces more gross profit and more operating profit than a dollar of revenue at almost any peer. This is partly due to the direct-to-consumer model, partly due to brand pricing power, and partly due to superb execution in operations (inventory, sourcing, etc.). It’s also why LULU can continue to invest in growth without sacrificing margins – there is ample “fuel” in the form of gross profit to fund new stores, R&D for new products, etc.

One might wonder if LULU’s superior margins are sustainable or if they will revert downwards as competition heats up. We believe they are sustainable, if not improvable, because LULU has structural advantages: a) Vertical retail – owning its stores and e-commerce means no wholesale markdowns, better control over pricing and branding, and higher average unit revenue. b) Premium positioning – LULU doesn’t compete on price; its customers are willing to pay $118 for leggings or $128 for a hoodie, and this insulates margins. In fact, in periods of inflation LULU can raise prices selectively (as seen in 2022–23) and consumers largely accept it. c) Economies of scale – as LULU grows internationally and in men’s, it leverages existing design and distribution infrastructure. We saw this in 2024 when, despite only ~10% sales growth, operating profit grew 17% and op margin expanded – indicating efficiency gains. d) Low promotional activity – LULU’s approach is to produce products in the right quantities to sell mostly at full price. Its “We Made Too Much” clearance section is relatively limited, preserving margin. All these factors give confidence that LULU’s margin profile isn’t likely to erode toward peers’. If anything, there’s room to optimize costs (for example, now that supply chain costs are normalizing, LULU expects slight tailwinds to gross margin from lower air freight usage and FX may drive incremental support).

Turning to the balance sheet, Lululemon is in a position most companies would envy. It carries no long-term debt. The only liabilities of note are lease commitments for stores, which are easily covered by store cash flows. At the end of Q3 2023, LULU had $1.1B in cash. By year-end (Jan 2025), after heavy buybacks, cash was slightly lower but still around $800M and a large untapped credit revolver stands by for any needs. This balance sheet strength means LULU has flexibility: it can opportunistically repurchase shares (which it’s doing), invest in supply chain improvements (like opening a 980k sq ft distribution center in Ontario in 2022 to support growth), or consider strategic acquisitions/partnerships from a position of strength. It also provides resilience; if a recession hit and sales temporarily slowed, LULU isn’t at risk of a liquidity crunch or onerous interest expense – they could even lean in and gain share while weaker competitors pull back or accelerate share repurchases.

Another point often overlooked: shareholder returns via buybacks are effectively boosting LULU’s EPS growth above net income growth. In 2024, LULU repurchased ~$1.6B of stock, and authorized a further $1B. The share count has been coming down – LULU bought back 1.5M shares in 2023 and 5.1M in 2024. With ~118M shares outstanding recently, that’s over 5% of the float repurchased in two years. It’s notable that even as the company continued to expand (capex for new stores, etc.), it generated enough excess cash to do this. That tells us LULU is now at a scale where it can be a growth company and a capital return story simultaneously – a rare transition point that often marks a stock’s move from a pure growth multiple to a higher “quality” multiple (once the market trusts the capital allocation). We think LULU is on the cusp of this inflection. If the company keeps retiring 2-4% of shares per year and growing net income double-digits, EPS could easily grow 15-20% annually without heroic assumptions. That warrants a far higher multiple than ~13× forward earnings.

Management’s alignment with shareholders is decent, though insider ownership could be higher (founder Chip Wilson retains a stake – he had about 8% as of 2021 after selling down from ~28%, and has been an outspoken voice for maximizing value). Executives are compensated in part on performance metrics like revenue and operating income growth. We have generally been impressed that LULU has not succumbed to pressures to chase unprofitable growth or dilute the brand for short-term sales. The Mirror deal was a misstep, yes, but they didn’t hesitate to reverse course. Now, management’s tone is one of focus and execution. CEO Calvin McDonald often reiterates they are “playing the long game” with innovation and international, which is what we want to hear. Given the strong results, we have no reason to doubt their strategy, but we will pose some questions in the final section about areas we think management could be even more transparent or aggressive to unlock value.

Finally, comparing LULU to other companies outside apparel highlights its unique position. LULU’s ~20% operating margins and 25%+ ROIC are reminiscent of top-tier consumer staples or tech companies rather than a typical retailer. It calls to mind Apple’s retail metrics or Starbucks’ pre-pandemic store economics. Yet LULU is valued at a fraction of those companies’ multiples – again reflecting a disconnect that we believe will close as LULU continues to deliver. It’s also instructive that some highly respected investors see value: Recently, Pershing Square’s Bill Ackman took a significant position in Nike, citing long-term brand strength. If one were to compare, LULU offers similar brand strength with even better growth, yet is cheaper. Scion Asset Management, the investment firm led by Michael Burry, has disclosed a long position in Lululemon, adding a high-profile value / activist investor to the company’s shareholder base. We wouldn’t be shocked if additional activist or high-profile value investors eventually target LULU if the market doesn’t wake up (outside of the low valuation, Chip Wilson’s presence and prior activism might support this). Alternatively, take-private LBO math comfortably underwrites a 20%+ IRR with modest debt assumptions as long as LULU remains under $200/sh (IRR could be higher if Chip Wilson or another large-holder rolled their equity stake into a take-private). In any case, LULU has all the financial hallmarks of a best-in-class operator in a growth industry – precisely the kind of company that over time tends to vastly outperform the market.

To wrap this financial overview: Lululemon is a high-growth, high-margin, high-returns company with an A+ balance sheet. Such companies are rare, and rarer still are they available at a bargain valuation. LULU’s numbers justify a premium – yet it trades at a discount. This is why we are pounding the table. In the final section, we tie everything together with our outlook on the stock’s upside and, importantly, pose some constructive questions for LULU’s management and board. These questions are aimed at ensuring that the company’s actions fully align with unlocking the substantial shareholder value we see on the table.

9. Upside Potential and Conclusion: A Severely Mispriced Winner

We believe LULU’s stock has significant upside – potentially 50% to 100% over the next 1-2 years – as the company’s performance forces a market re-rating. Our conservative valuation scenario, assuming modest growth and a still-below-historical multiple, yields a stock price well above current levels. In a bullish scenario (steady double-digit growth, successful new categories, and multiple expansion toward peers), LULU could approach or surpass its previous highs, delivering a doubling from the recent ~$170 share price. The risk/reward, in our view, is heavily skewed to the upside given LULU’s strong fundamentals and undervaluation. We conclude that Lululemon is a high-quality compounder temporarily misunderstood by the market, and as clarity returns, patient investors stand to be richly rewarded. This is a call not just for investors to recognize LULU’s value, but for LULU’s own leadership – including the Board and Executive teams – to take proactive steps in highlighting and enhancing shareholder value (as outlined in our questions for management).

Let’s outline a simple valuation to anchor the upside. Lululemon guided FY2025 (calendar 2024) revenue to ~$10.6B which it achieved, and analysts expect FY2026 (calendar 2025) revenue around $11.5B–$12B (roughly 8-10% growth). Given current trends (international +30%, men’s + mid-teens, slight U.S. improvement), this is achievable if not beatable. Assuming LULU hits $12B revenue in FY2026 and maintains an operating margin ~23-24%, that’s operating income of ~$2.8B. Tax ~29%, net income ~$2.0B. With the share count already shrinking (say ~115M by then after buybacks), that’s EPS of about $17–$18. Now, what multiple does a company with LULU’s profile deserve? Historically, LULU traded 25-35× earnings when growth was higher; Nike trades around 25× forward despite its recent struggles; the S&P500 is ~18×. Given LULU will still be growing high-single/low-double digits with a premium brand and possibly initiating dividends by then, we argue for at least a market multiple or slight premium. At 20× $17, the stock = $340. At 25×, it’s $425. Discount that back a bit or apply a probability, and it’s evident that the stock should be well north of $300 in a year or two, barring a severe recession. Even a very cautious case: say growth stalls at 5% and EPS is $15, and it only gets a 15× multiple – that’s $225 (still ~35% above today). So downside appears limited relative to upside, considering the balance sheet could support buybacks even in a downturn.

Another angle: LULU’s current EV/EBITDA ~7x is simply too low. Quality consumer names (think Starbucks, Estee Lauder, etc.) often trade at mid to high teens EV/EBITDA. Even an expansion to 12x (justifiable given 23% margins and 10% growth) would raise the EV by ~70%, implying the stock similarly. Some may counter that as a “maturing” retailer LULU should have a low multiple. We reject that – LULU is not a mall-bound chain facing decline; it’s an evolving global brand with avenues for decades of growth (international, category, digital). If anything, it should eventually be valued more like a premium consumer staples company (think Nike or Coca-Cola multiples) given its loyal customer base and pricing power.

The upcoming catalysts that could unlock this value include: Acceleration in China (potential double-digit comp quarters from that region, which management might disclose if impressive); Gross margin expansion above 60% (quite possible as mix shifts to direct and air freight costs fully normalize, which would boost EPS); Continued buybacks (shrinking float, increasing ownership per share of the company’s earnings); and simply time/data – as LULU strings together a few more quarters of hitting targets, the skepticism should abate. We note that the stock’s slide in 2025 came as the market lost “faith” in guidance – ironically just as margins rebounded and Mirror ended. Once investors realize that the post-COVID hangover is done and LULU is still delivering mid-teens EPS growth, we expect multiples to expand from the current trough.

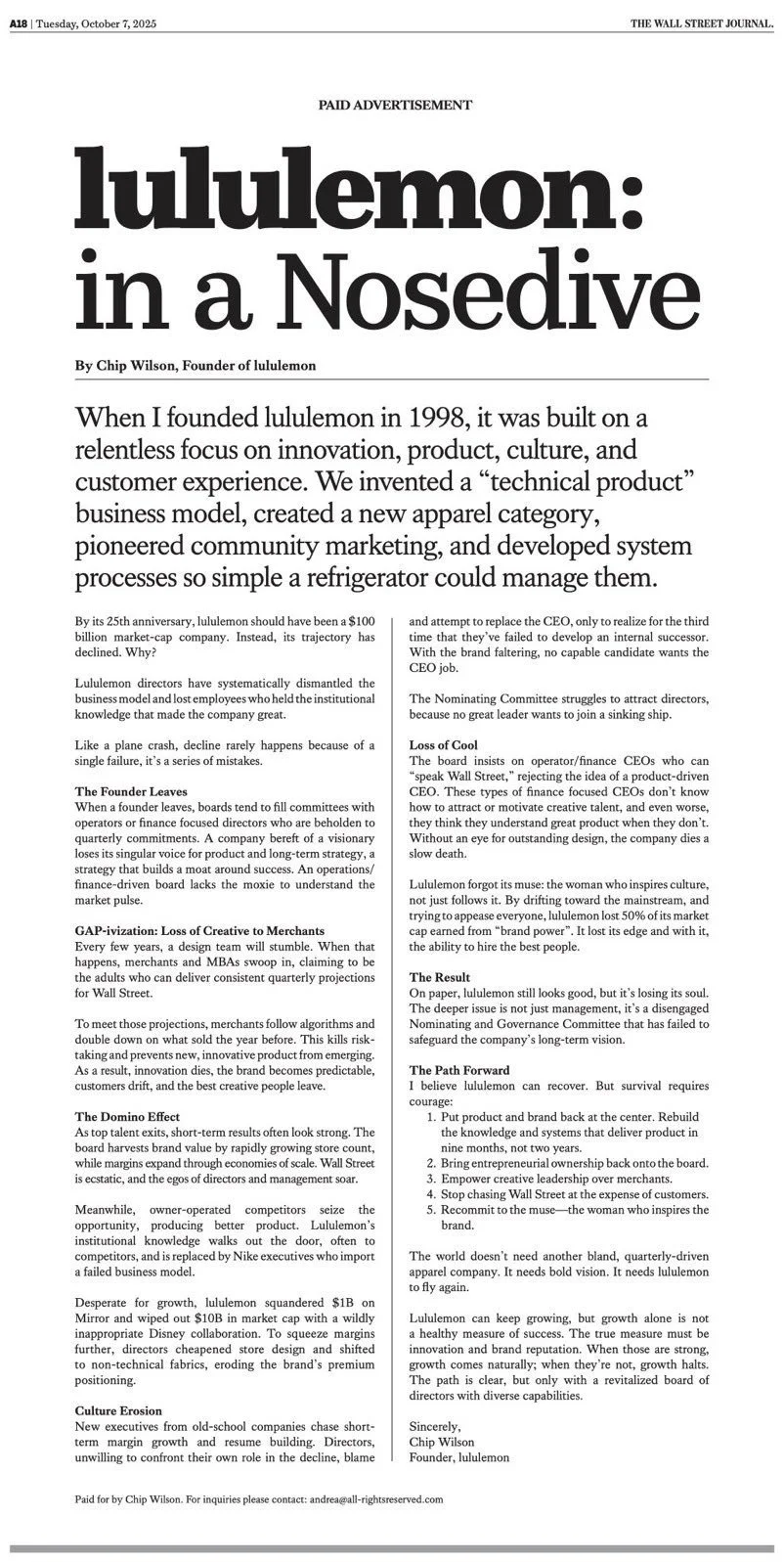

There is also a wildcard: founder Chip Wilson.

He has historically been vocal when he felt the company was mismanaged or the stock undervalued (famously agitating in 2014 and writing open letters). While Chip stepped away from board roles years ago, he remains an influential figure and large shareholder. We suspect he, too, recognizes the current undervaluation. In the past, Chip criticized product quality control and urged the company not to stray from its DNA. In September 2025, Chip took a full-page ad in the WSJ calling for change at LULU. If he were to continue speaking up now, it might be to encourage a sharper focus on innovation and perhaps even suggest strategic moves (e.g., exploring whether LULU could unlock value via spinoffs or increasing buybacks). His involvement could act as a backstop, as management would not want a public dispute. Alternatively, he could partner with an activist fund or private equity to drive change or take the company private. It’s speculation, but a positive one: a founder who cares about maximizing the brand and shareholder value is in the wings.

WSJ ad shown left.

In conclusion, Lululemon Athletica represents a compelling long investment as an undervalued leader with multiple growth cylinders firing. The market’s overly cautious stance – essentially pricing LULU like a no-growth or risky venture – is fundamentally at odds with the vibrant reality of LULU’s operations. We see this as an opportunity to be greedy while others are fearful. Rarely can one find a company of LULU’s caliber (global brand, high margins, solid growth runway) at such a modest valuation. We believe a combination of continued execution by the company and a push from engaged shareholders (including activists or the founder if needed) will close this gap.

To that end, we present below a series of constructive, hard-hitting questions for Lululemon’s management and board. These questions are intended to prompt clear answers and actions that will reassure investors and potentially catalyze strategic moves to unlock value. They reflect the kind of accountability that short-focused activist reports demand – except here, our aim is to drive positive change and recognition of LULU’s value. By addressing these questions, Lululemon’s leadership can help ensure that the company’s outstanding performance translates into outstanding stock performance for its owners.

10. Questions for Lululemon’s Management and Board

We challenge Lululemon’s leadership to address the following critical questions to maximize shareholder value and dispel lingering concerns. In true activist fashion, we pose direct questions covering strategy, capital allocation, and execution. Clear, forthright answers (and corresponding actions) will signal management’s commitment to realizing LULU’s full potential:

North America Re-Ignition: After low Americas growth in 2024, what is management’s plan to re-accelerate North American sales? Can you provide specific initiatives (product innovation, marketing campaigns, store experience upgrades) to drive renewed growth in your home market without eroding margins? How will you continue gaining market share in a competitive U.S. landscape?

International Acceleration: Given the tremendous success in China, will you consider increasing the pace of international store openings or partnerships to capitalize on demand? For example, can expansion in high-potential markets (e.g. more stores in China’s Tier 2 cities, entry into India or more of EMEA) be accelerated beyond the current plan of 40-45 new stores in 2025? Why the franchise model for India? What safeguards ensure you maintain brand cachet and execution quality as you scale globally?

Margin Enhancement: With gross margin back near 60% and adjusted operating margin ~23-24%, what are the targets or opportunities for further margin expansion? Can you quantify benefits from supply chain efficiencies (e.g., reduced air freight usage or distribution optimization)? Will you commit to a long-term operating margin range (say mid-20s%) to give investors confidence that profitability will remain a priority even as you invest for growth?

Inventory Discipline: Inventory issues plagued many retailers recently. How will Lululemon ensure it does not repeat the over-inventory issues of the past? Can you share targets for inventory growth versus sales growth, or inventory turnover ratios, that management will adhere to? What systems or process improvements have been implemented to better align inventory with demand (especially as you expand product lines and regions)?

Product Quality and Innovation: Founder Chip Wilson has emphasized product quality as paramount. What are you doing to address any perceptions of declining quality (e.g., reports of fabric changes or durability concerns)? Are product returns or defect rates tracked and trending favorably? Moreover, how are you fueling the innovation pipeline – can you maintain Lululemon’s reputation for cutting-edge fabrics and functionality (e.g., like the recent enzymatically recycled nylon initiative)? We’d like to hear about specific upcoming product innovations that exemplify LULU’s leadership.

Footwear Strategy: Now that you have launched women’s and men’s footwear, what constitutes success in this category and over what timeframe? How will you measure the traction of your footwear segment (e.g., internal sales targets or market share goals)? At what point would you consider more aggressive investment (or conversely, a pivot) in footwear? Essentially, how big do you expect the footwear business to be in, say, 3 years, and what’s the roadmap to get there – new models, distribution channels, athlete endorsements?

Men’s Business Goals: You set and achieved a goal to double men’s between 2018-2023; what is the updated goal for men’s segment over the next few years? Will you begin disclosing the men’s vs women’s revenue split regularly (as you did in the annual report) so investors can track progress? Additionally, what marketing efforts are underway to continue increasing brand awareness among men (for example, will you consider larger-scale advertising or sponsorships in men’s sports beyond the recent ambassador additions)?

Capital Allocation & Buybacks: With $1+ billion in cash and strong cash flow, will you maintain an aggressive share buyback program at these undervalued prices? You repurchased 5.1M shares for $1.6B in 2024 – will you consider utilizing the full remaining authorization (and even expanding / accelerating repurchases) given the stock’s decline? Additionally, has the Board discussed initiating a dividend to return cash to shareholders, or do you prefer buybacks exclusively? We seek assurance that excess cash will be used for shareholder benefit, not left idle or spent on another risky acquisition (Mirror).

Founder and Board Engagement: Founder Chip Wilson remains an influential shareholder and voice. How is the Board engaging with Chip and leveraging his insight on product and brand? Would the Board consider adding members with deep product/design expertise or entrepreneurial track records to further strengthen oversight as the company grows in complexity (international, new categories)? Simply: is there an open line of communication between LULU and Chip to address his legitimate concerns and unlock shareholder value?

Communication and Guidance: LULU’s stock dropped after some recent earnings due to cautious guidance. How can management improve communication with investors to avoid surprises and better convey the underlying health of the business? For instance, would you consider providing more granular metrics on quarterly calls to highlight the strong areas (e.g., men’s, footwear) and give context to softer spots? Also, as we lap the Mirror charges, will you commit to a cleaner reporting of adjusted results so the core performance is crystal clear? In short, what steps will you take to ensure the market fully understands Lululemon’s growth story and does not undervalue it due to opaque guidance or one-off expenses?

Competitive Landscape and Moat: Finally, how is Lululemon fortifying its moat against rising competition? Are there any plans to broaden the loyalty program into a tiered or paid program that drives even more engagement (e.g., bringing back a premium tier with perks now that Peloton content is in place)? How will you continue to differentiate in an increasingly crowded athleisure market – is it through exclusive fabrics, community experiences, personalization via your guest data? Investors want to know that LULU will remain the leader and not cede ground as others chase the attractive athleisure trend.

We look forward to candid responses from Lululemon’s leadership on these points. By addressing these questions, management can instill greater confidence that the company is not only performing well but also being proactive in maximizing shareholder value. In our view, Lululemon has all the ingredients of a long-term compounder – brand strength, growth avenues, and strong governance – and with sharper execution and transparency, its stock price should eventually reflect that reality. The onus is now on the company to deliver and communicate, and on investors to see through the fog of recent skepticism. Lululemon is a rare asset: a dominant, growing, highly profitable brand hiding in plain sight at a bargain valuation. We are bullish, and we believe the story of LULU’s undervaluation won’t last for long. It’s time for the market to awaken to the real value here.

Disclosure

We are long LULU. This report reflects our opinions and research, which we believe to be accurate. We encourage readers to consider the sources cited and to conduct their own due diligence. We have no business relationship with Lululemon other than as a concerned shareholder. Our aim is to highlight value and advocate for actions that benefit all LULU stakeholders – customers, employees, and shareholders alike. Lululemon’s best days look to be ahead of it, and we are excited to be along for the journey.

Sources

lululemon athletica inc. Announces Third Quarter Fiscal 2023 Results Board Of Directors Authorizes $1.0 Billion Stock Repurchase Program | lululemon

https://corporate.lululemon.com/media/press-releases/2023/12-07-2023

lululemon athletica inc. Announces Fourth Quarter and Full Year Fiscal 2024 Results | lululemon

https://corporate.lululemon.com/media/press-releases/2025/03-27-2025-200544345

Lululemon vs. Nike: Which Stock Offers Better Long-Term Value? - Sven Carlin

https://svencarlin.com/lululemon-vs-nike-which-stock-offers-better-long-term-value/

Deep dive into Lululemon - Outsmarting Nike and Adidas - Reddit

Lululemon Manages Q4 Earnings Beat @themotleyfool #stocks $LULU

https://ground.news/article/lululemon-earnings-are-coming-guidance-matters-most

Sinking 48%, Is Lululemon a Buying Opportunity? | The Motley Fool

https://www.fool.com/investing/2025/11/20/sinking-48-is-lululemon-a-buying-opportunity/

Lululemon (LULU) Dips More Than Broader Market - Yahoo Finance

https://finance.yahoo.com/news/lululemon-lulu-dips-more-broader-224503581.html

Lululemon: The Situation Is Better Than You Think (NASDAQ:LULU)

https://seekingalpha.com/article/4813011-lululemon-the-situation-is-better-than-you-think

LULU Intrinsic Valuation and Fundamental Analysis - Alpha Spread

lululemon: A Quality Compounder Trading At Discounted Multiples

Lululemon Slips as Rivals Rally: 3 Stocks to Watch - MarketBeat

https://www.marketbeat.com/originals/lululemon-slips-as-rivals-rally-3-stocks-to-watch/

Here's 5 value plays trading at multi-year PE lows : r/ValueInvesting

Does Lululemon's 56% Drop in 2025 Signal an Opportunity for ...

https://finance.yahoo.com/news/does-lululemon-56-drop-2025-181139755.html

Has the 54% Drop in Lululemon Shares Created a 2025 Bargain ...

Lululemon Athletica Stock (LULU) Opinions on Significant Price ...

Customers Love These 3 Healthcare Companies - Nasdaq

https://www.nasdaq.com/articles/customers-love-these-3-healthcare-companies

2024 Annual Report

Customer Loyalty Statistics (2025) - SellersCommerce

https://www.sellerscommerce.com/blog/customer-loyalty-statistics/

2023 Annual Report

lululemon and NFL Announce Elevated Fan Apparel Collection Across NFL Shop, Fanatics, and Team Shops | lululemon

lululemon NPS & Customer Reviews - Comparably

Lululemon to discontinue Mirror as it teams up with Peloton | Retail Dive

[PDF] Q3 Fiscal 2023 Earnings Commentary Sales Store Count Gross Profit

Lululemon Is Fairly Valued After Double-Digit Drop - Yahoo Finance

https://finance.yahoo.com/news/lululemon-fairly-valued-double-digit-140001733.html

lululemon athletica inc. (NASDAQ:LULU) | Return on Capital

Lululemon Beyondfeel Running Shoes Review 2024, Tested - GQ

https://www.gq.com/story/lululemon-beyondfeel-running-shoe-review

lululemon Expands Its Footwear Offerings with New Casual and ...

https://corporate.lululemon.com/media/press-releases/2024/02-01-2024-143021807

Lululemon enters men's footwear with casual sneaker launch

Lululemon Lays Off Workers After Peloton Partnership and ...

lululemon and Fanatics Partner with NHL® to Launch New Premium Fan Apparel Collection — Fanatics Inc

Lululemon partners with NFL to release apparel collection | Reuters

https://www.reuters.com/sports/lululemon-partners-with-nfl-release-apparel-collection-2025-10-27/

lululemon athletica inc. Announces Fourth Quarter and Full Year ...

https://corporate.lululemon.com/media/press-releases/2024/03-21-2024-200524108

American Express Platinum and lululemon Benefits

https://shop.lululemon.com/help/programs-and-discounts/amex-benefits?

Move into more with lululemon and the American Express Platinum Card®

https://shop.lululemon.com/story/amex-platinum-partnership?

Platinum’s Elevated Lifestyle Benefits Can Help Make Every Day an Adventure

https://www.americanexpress.com/en-us/credit-cards/credit-intel/amex-platinum-benefits/

10 TPG-recommended items to buy with your $75 Amex Platinum Lululemon credit

https://thepointsguy.com/credit-cards/top-items-to-buy-amex-platinum-lululemon-credit/